When we started the Money Coaches, we did so because we felt that providing financial coaching filled a very real need and that it could benefit just about anyone. The way we thought it could help the most was as an employee benefit. While we are happy to help individuals, our main focus has been on working with companies to do just that. Why?

When you need financial coaching most, it might not be possible for you to afford it. Working with a certified money coach is relatively inexpensive considering the long-term benefits that can be had from the experience, but when you are in rough financial shape, it simply may not be doable. Having that option made available by your employer could mean you are able to take advantage of it when you need it the most without worrying about the cost.

We believe that because of this, people are more likely to take advantage of financial coaching and that allows us to do the most good. Perhaps the most amazing thing is that we are not alone in thinking this make sense. This is apparently becoming a more common thought process among many large companies.

According to an article published in the Wall Street Journal, more companies are beginning to offer incentives to their employees for reining in their spending and getting their finances in order:

Among U.S. corporations with so-called financial-wellness programs, which are designed to teach employees basic money-management skills, 17% offered incentives for participation in 2016—the most recent year for which data is available—up from 10.7% in 2014. An additional 8% said they were considering such a move, according to the International Foundation of Employee Benefit Plans.

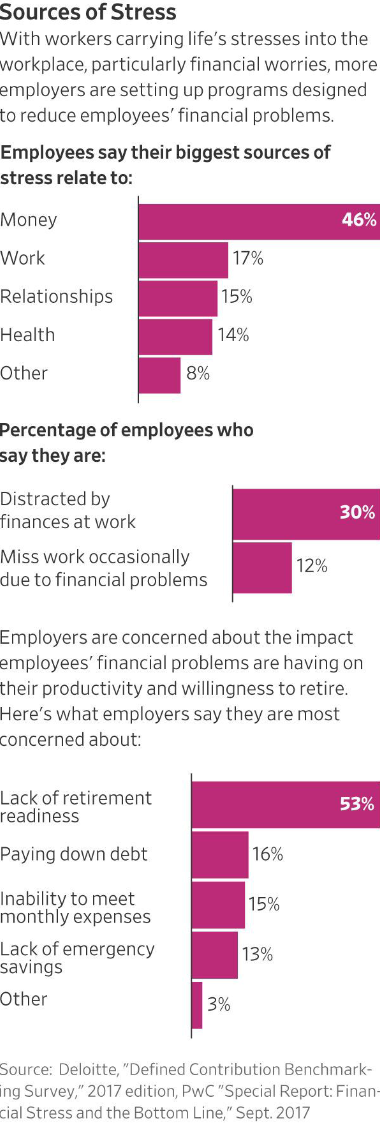

This is exciting news to us at the Money Coaches! We love hearing that employers are recognizing what we have already: there is a very real need for more people to be provided with financial coaching and education. The facts in this article support that as well:

According to a survey published in 2015 by the American Psychological Association, 72% of adults say they worry about money. The Federal Reserve says 44% of adults lack the funds to cover a $400 emergency.

To tackle this, companies are using incentives to boost participation in financial-wellness programs. These typically combine financial education with customized advice delivered by mobile apps and human advisers. The goal: to teach employees basic money-management skills and remind them—via text messages, emails or one-on-one meetings—to stick to budgets, pay bills and save more for everything from emergencies to retirement.

Currently, 17% of large companies offer financial-wellness programs that incorporate online tools and 42% offer one-on-one consultations, up from 9.2% and 35%, respectively, in 2015, according to investment-consulting firm Callan LLC. More than half of employers say they plan to take steps this year to create or enhance these programs, says a recent survey from 401(k) record-keeper Alight Solutions LLC.

So if your company offers financial coaching as a service, consider yourself lucky! If they do not, you should recommend to your human resources person that they investigate adding it. We have several ways you can do that. You can simply tell them about the Money Coaches and hope they reach out. Our website is easy to find and getting in touch with us is fairly simple as well. Depending on how motivating your request, that might work, but it could just end up on someone’s “to do” list.

Maybe the best thing to do is to actually fill out our company referral form. It is really quick and simple, but it allows us to reach out to your employer and make contact with the right person to get the ball rolling and get your company on its way to providing a valuable service to you. It also gives us the ability to let your employer know that it is a service one of their own employees thought was a valuable one.

There may be some of you who are at a different stage of life and are not living paycheck to paycheck, and therefore do not feel that financial coaching would be a significant advantage to you. I want to stress that while a lot of what we do deals with basic budgeting and personal finance, at the Money Coaches, we do a whole lot more.

Our coaches sit down with people who are preparing to send kids to college and need advice. They talk with those who are preparing to retire and have questions. When tumultuous financial situations arise unexpectedly, our coaches are there to sit down with you and help guide you through them. This is truly a service that can benefit anyone at any stage of life and help you to do better financially than you are today, so talk to your employer about providing financial coaching services through the Money Coaches!

Check out the full Wall Street Journal article here. (Just FYI This article requires a subscription to read in its entirety, but it seems that it can be viewed on a mobile device without one.)