How To Live On A Budget

What does it mean to live on a budget? Being on a budget is sometimes misunderstood to mean that you do not have much money. For example, you have probably heard someone say they are on a pretty tight budget. They might refer to a lower cost item as a “budget” item to mean that it is cheaper and of lower quality. However, a budget is not something you only need when you are short on money. It is the reality that successful people use to help direct their money to where it needs to go. Your money behaves perfectly. It doesn’t spend itself on shiny new electronics, elaborate vacations, and fancy clothes. Your money does exactly what you tell it to do. That is where a budget comes in.

A budget is simply a written plan for your money. It is the pathway that you will direct your money through to make sure that at the end of the month you haven’t spent what was supposed to pay your electric bill, at Starbucks. If you want to break the cycle of living paycheck to paycheck, having a budget and updating it monthly is a must. The good thing is it is not very difficult to do. Here are the steps to get you started:

1. The Basics – Write Out Your Expenses

It is easy to get freaked out about a budget when you are first starting. If you have typically been bad with your money it might seem like an insurmountable task. Thankfully, this step is pretty easy. Just sit down and write out all the things you spend money on monthly. It doesn’t have to be a comprehensive list and the amounts don’t have to be exact. To begin with, we just want to get a general idea of what you spend.

It is easy to get freaked out about a budget when you are first starting. If you have typically been bad with your money it might seem like an insurmountable task. Thankfully, this step is pretty easy. Just sit down and write out all the things you spend money on monthly. It doesn’t have to be a comprehensive list and the amounts don’t have to be exact. To begin with, we just want to get a general idea of what you spend.

Start by writing down what you expect to spend on a basic needs basis. Food, shelter, clothing, etc.

To make that even easier I’m attaching the budget forms from Ramsey Solutions for you to download. The quick start budget form will cover most of your significant expenses and give you an idea of where your money is going. This is mainly the essentials: food, shelter, clothing, and transportation. Actually thinking about where all that money is going and writing it down might surprise you. It might traumatize you a little bit too, but I promise it will help you in the long haul!

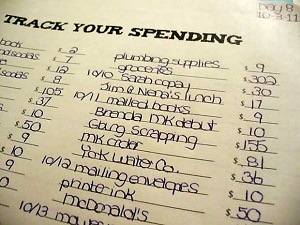

2. Track Your Spending

Write down everything you spend. It might shock you!

Write down everything you spend. It might shock you!

The next step is equally simple. For one whole month, you need to track and write down every single dollar you spend! When I say every dollar, I mean it! Don’t fudge the records or keep some expenses off the books. It won’t be me you are hurting if you do. At the end of the month, you will have some invaluable information. If you have wondered why you can’t seem to get ahead, an in depth look at your spending like this will give you some very good insight into what might be keeping you stuck.

Maybe you will find out that your transportation budget is taking up way too much of your income. Perhaps you will discover that you are spending three times more than you thought eating out. You might even come to the conclusion that you need to get an additional job or change jobs completely because your income simply is not adequate to your basic needs. One thing is certain, you will have a better handle on how to write a realistic and functional budget after this exercise. Don’t skip it!

3. The Budget – Time to Write The Thing

Okay, so you’ve gotten through the first two steps and know pretty closely where your money is going. Now it is time to write out your plan. You can use the monthly cash flow form if you downloaded the budget forms I included from step one. Write out what you expect to spend on each line item in the coming month. Each category on the form gives a recommended percentage for that category which relates to your take-home pay. This is a good guideline for how much you should be spending on each category, but might not be an exact fit for your budget. It is important to update your budget monthly. If you aren’t updating the information regularly, your budget will not be accurate and can cause a problem.

Once you have filled in all of the categories fully and comprehensively with as close an estimate as you can make on each, you should have a balance that totals to zero. If you do all this and end up with a negative balance, you will have to modify your budget to make sure you have enough money for each item. This might mean trimming areas of spending where you are able to do so, or increasing your income with a second job.

Once you have filled in all of the categories fully and comprehensively with as close an estimate as you can make on each, you should have a balance that totals to zero. If you do all this and end up with a negative balance, you will have to modify your budget to make sure you have enough money for each item. This might mean trimming areas of spending where you are able to do so, or increasing your income with a second job.

If after filling out the form you have money left over, great! That means you have been thrifty in your budget. However, if you do not tell that money where to go in writing, the chances are high that it will find somewhere to go on its own. Money rarely finds your savings account without direction, but has a keen sense of how to end up at your local restaurants. So if you have money left over, edit your budget to put it somewhere. Your first step is to save $1,000 in an emergency fund and do it quickly. For those that do, put that extra money down on your smallest debt and start the debt snowball process. Once you are doing this right, it won’t be long before that extra money grows and you are able to really start knocking out your debt and beefing up your savings!

Baby Steps

Maybe you feel like the full blown budget is too tall a task to jump into right away. If that is the case, get your feet wet with the quick budget form and track your spending each month. You can use something like the Every Dollar app or simply write everything down on paper. Do that for a couple months, and once you feel comfortable, switch to the more comprehensive form and really begin to dig into your budget. It is better to develop good habits than to do it all right at once. We would rather you build sustainable budgeting habits for the long haul than doing a “crash diet” style budget and give up in a month!