Why would I need a money coach?

That’s the first question most people ask themselves when they hear about what we do at The Money Coaches. It’s a fair question and one that bears investigating. Why would you need a money coach? As it turns out, there are a lot of reasons why you might need to talk with us.

Like most financial discussions, there are variables affecting the direction a conversation goes. Your own financial knowledge, stage of life, job satisfaction, current financial position, and goals will all impact what benefit a money coach would provide you. What I can tell you with certainty is that there is an advantage in talking to a trained professional to get help organizing your finances and changing your financial story. That statement coming from a person who provides coaching services makes you skeptical, I am sure! That’s okay. I know that we live in a world that is skeptical by default.

Let me be really honest when I say that we can live without your business. At The Money Coaches, we do what we do because we care about improving people’s lives. I know that a totally altruistic mentality in a company is hard to believe, but it is true. People are the bottom line for us. We do want to make a living, just like you do, but we are far more concerned with our eternal impact than the pursuit of the “almighty dollar.”

When we started this, the goal was never to get wealthy, but to make a living doing something that could make a real difference in the lives of others. So that is what we are here to do. Whether you believe that is up to you, but if you get to know any of us, I am confident you’ll buy in like we all do.

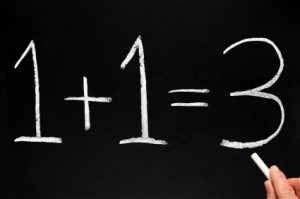

A look at the numbers compelled us to create this service.

At its root, financial management is a math problem. The issue is that your calculator also has all these emotional and external inputs that are distorting how to get the proper solution and making things way more difficult than they should be. The end result is a pretty ugly picture on a national scale:

- As of the end of 2016, the average credit card debt in America was $16,000

- Average household debt, mortgage included, was $132,500

- Nearly three-quarters of all Americans live paycheck-to-paycheck

- A study last year showed nearly half of Americans earning between $100,000 -149,000 annually had less than $1000 in savings.

That is a bleak look at the current state of personal finance in the United States. It is easy to try to paint that picture using people at the bottom of the pay scale. It is easy to try to pigeon hole this problem as being related to a certain segment of the population. However, the numbers don’t match up to those narratives. Struggles with debt reach across age, gender, race, class, cultural and political lines. Music isn’t the only universal language, debt translates seamlessly.

There are some hard questions you need to ask yourself, and questions you may not have grappled with. Let me give you an example:

From time to time, household appliances malfunction and give out. It never fails that this happens along the most inconvenient timeline possible. It usually takes place right after a paycheck has been completely depleted by one of our more significant payments. In some cases, this can mean nothing more than a minor inconvenience, like losing a dishwasher. Thankfully if you have a sink this doesn’t stop you from having clean dishes, even if it does make you grumble a bit more. Some of you are thinking you haven’t got one to lose anyway!

In others, like the loss of a washing machine or dryer, it might mean significant inconvenience, like adding trips to the laundromat to your already full schedule. But in some cases, especially if you are living paycheck to paycheck, it can mean disaster.

Here’s the situation:

Imagine your refrigerator stops working. Keep in mind that this generally happens on the worst possible timeline. So in our scenario, you have just been grocery shopping and that baby is full to capacity. You have enough money to keep your vehicle fueled, as well as to pay your electric bill, which is due. It is hard to explain the fear that grips you when you know you’ve spent all your paycheck, bought your groceries, and now may be faced with losing all the food you purchased. If you have experienced it, you don’t easily forget it.

Imagine your refrigerator stops working. Keep in mind that this generally happens on the worst possible timeline. So in our scenario, you have just been grocery shopping and that baby is full to capacity. You have enough money to keep your vehicle fueled, as well as to pay your electric bill, which is due. It is hard to explain the fear that grips you when you know you’ve spent all your paycheck, bought your groceries, and now may be faced with losing all the food you purchased. If you have experienced it, you don’t easily forget it.

The cheapest refrigerator that I found was listed at Sears’ for $429. When you factor in tax and delivery charges you are facing more than $500 in cost to replace your refrigerator with the cheapest one available, a fact which may hurt you down the road. If you can somehow scrape together enough to cover that cost and replace the refrigerator, you may still lose the food and be forced to either replenish your food supply, eat out, or go hungry. To add insult to injury, Monday morning your child wakes up with a high fever and sore throat. Between your copay and the cost for any medication, you are looking at paying your electric bill late and risking shutoff, late fees etc.

Is there any part of you that truly believes this is a completely impossible scenario? Of course not! This kind of thing could happen at any time and to anyone. Appliances fail and kids get sick. When that happens and you don’t have a plan, what should be an irritating inconvenience becomes a major problem.

Now given that scenario, let me provide a contrast by showing what it looks like to someone with a plan in place:

The same circumstances unfold. The difference is that you’ve worked hard to get your emergency fund in place. You’ve written a good budget and stuck closely to it. Because of this, you have money that is earmarked for the surprise doctor’s visit and medication. While your budget did not account for your refrigerator’s failure, your emergency fund did. You accrued the minimum of $1000 in your emergency savings account, and so were able to buy a replacement refrigerator as well as replacing any groceries you lost. The only real urgency you should feel is the one pushing you to get to work replenishing that emergency fund.

The same circumstances unfold. The difference is that you’ve worked hard to get your emergency fund in place. You’ve written a good budget and stuck closely to it. Because of this, you have money that is earmarked for the surprise doctor’s visit and medication. While your budget did not account for your refrigerator’s failure, your emergency fund did. You accrued the minimum of $1000 in your emergency savings account, and so were able to buy a replacement refrigerator as well as replacing any groceries you lost. The only real urgency you should feel is the one pushing you to get to work replenishing that emergency fund.

So the question you need to ask is this:

If this situation happened to me, do I fall closer to the first scenario or the second?

For around 75% of the population, the honest answer would be the first. That should disturb you more than a little if you are in that group. If your refrigerator going out throws off your whole world, what will you do when you have a car accident? Or an unexpected medical problem? Or lose your job? These are all very real issues that require your thought and planning.

Here might be the most important thing to note: wealthy people aren’t wealthy by accident. You may be on the Powerball savings plan but there are better ways to help you succeed and we want to be there to walk you through them. Accountability and guidance from trained professionals can maximize your chances of succeeding in meeting your financial goals. Don’t wait for disaster to strike to create your plan for success. Start now!